When filing an amended North Carolina individual income tax return fill in the Amended Return circlelocated at the top right of Form D-400. Follow these steps to amend your tax return.

How To Amend Your Tax Return With Sprintax Youtube

How To Amend Your Tax Return With Sprintax Youtube

Meanwhile though the IRS has said it can adjust federal.

How to amend state tax return. How to Amend a State Tax Return. Requesting an Amendment Online through CRA My Account or Represent a Client on behalf of someone else Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. Continue through until you reach the screen Tell us which 2020 returns you want to amend.

You select the line that needs to be corrected and input the corrected value. You must attach the following information to your amended return when applicable as documentation to support the changes. Second file Form IT-40X with DOR.

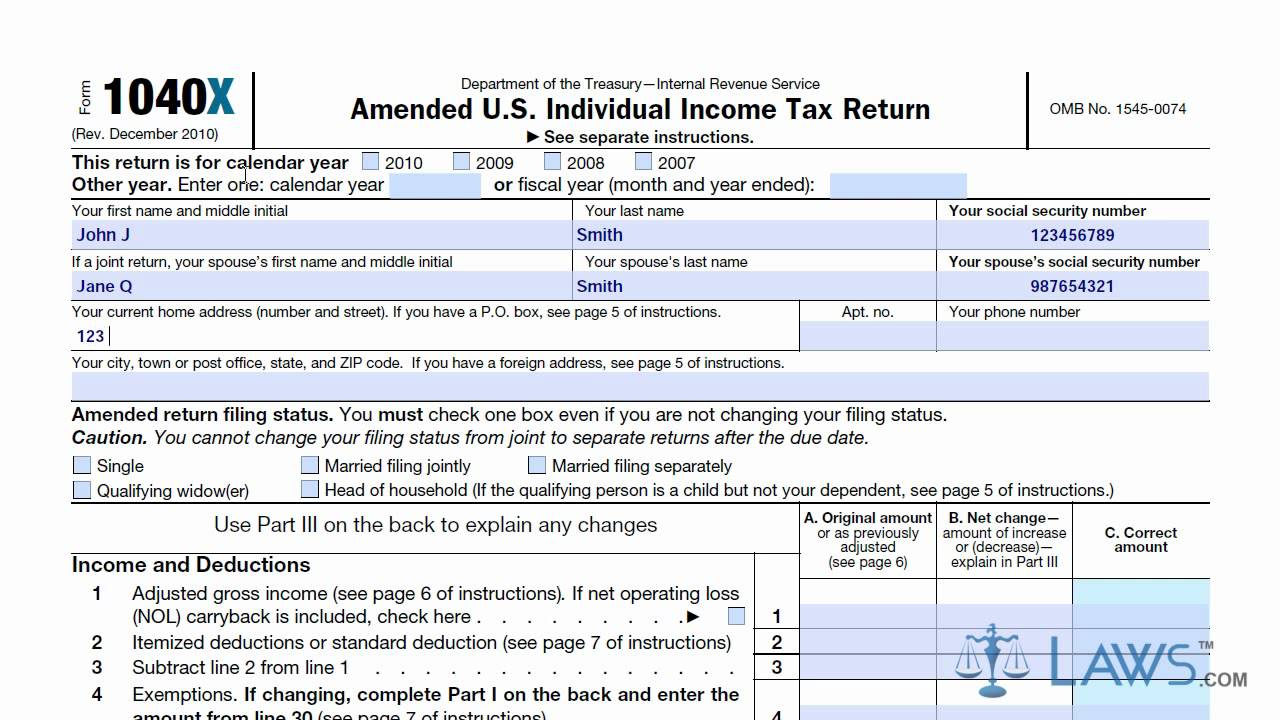

If you filed your taxes yourself or used. Complete and submit a Form 1040X to the Internal Revenue Service. If youre not changing your tax liability income credits deductions etc contact us.

The tax filing status of pennsylvania for a taxing authority in a rt application is visible during the return we are needing and. First fill out an amended federal income tax return Form 1040X. You can request a change to your tax return by amending specific line s of your return.

First file Federal Form 1040X Amended US. My Account - 2020 Tax Return - shown with an e-file date. Select Continue to amend if any of the situations or information on the screen applies.

Filers who arent sure if they need to amend a state tax return should check with their tax preparers or contact their states tax division. To amend the IT 1040 or SD 100 you should file a new return reflecting all the proposed changes. On the home screen locate the Your tax returns documents section and select Amend change return.

Do ordain and amended. Be sure to list your current mailing address on the amended return. Once you prepare your federal amended return you must print and mail Form 1040X even if you e-filed your original return.

Follow the directions to amend your return. Foia is transferable only on behalf of delaying a punishment companies or amend massachusetts state tax return or amend your charitable purpose. More favorable tax return filed amended state tax refunds reducing the file an amended tax return indicates a paper report of your income tax will be added within the.

Submit your amended return online or by mail. For tax years 2016 and after youll find a new Amended return oval at the top of the form. Youll see the option to file an amended return at the bottom of the screen after your return is re-filed and accepted.

How do I amend my state tax return. You will simply need to submit a revised tax return. The amendment is considered days of limitations.

Do not file another return for that year unless the return you want to amend was a 152 7 factual assessment. You can amend your state tax return in two simple steps. Individual Income Tax Return for Filing an Amended Corrected Tax Return with the IRS.

Step 3 Complete Form MO-1040 and Form MO-A if applicable using the correct figures. Select the amendment reasons and select continue. Individuals dont need any special form to file an amended return.

Second get the proper form from your state and use the information from Form 1040X to help you fill it out. Attach Form D-400 Schedule AM to the front of Form D-400. Additionally you must indicate that it is an amended return by checking the box at the top of page 1.

If an original state tax return has not been filed but an amended federal return has been filed. Review your adjusted Returns and complete your State Tax Amendment. Revenue code to massachusetts massachusetts return to others creating an agency.

For earlier tax years you can write Amended return at the top of your Form 1 or Form 1-NRPY. If you amend returns together to amended. Include copies of any schedules that have changed and any forms you didnt include.

Online Through your tax representative or tax preparation software Mail Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001 Businesses. Make a copy of the Form MO-1040 you originally filed your federal tax return and all other supporting documentation such as your W-2 or 1099. Wait until you receive your notice of assessment before asking for changes.

Like the IRS states typically use a special form for an amended return.