Here are a few possible reasons your credit score could drop. If you paid off some debt but your score dropped the alert was only made because MyFico sensed you paid down debt so it pulled a brand new report you cant see the report from alerts and recalculated your new FICO score based on that new report.

Why Your Credit Score Dropped 13 Common Reasons A Fico Score Declines National Credit Federation

Why Your Credit Score Dropped 13 Common Reasons A Fico Score Declines National Credit Federation

Its due to be - 6225564.

Why is my fico score dropping. If possible pay down the. And then why a specific lender is looking at my FICO score which FICO I mean by which institution score he generally refers to. One item I might recommend is getting a second credit card especially if you still have a high score over 730 and.

I disputed the items and they were removed. That makes me suspect that you think there is only one FICO score out there. Having low credit utilization 30 or less and the lower the better is good.

These two reasons may explain why your FICO score has been dropping. If yours drops dramatically you want to look into it right away. Credit card and loan payments more than 30 days past due are reported to the credit bureausand are reflected in your credit score.

Newly implemented FICO scoring metrics can drop your credit score by20 points for habitually paying your bill late. It is one reason your credit score could drop a little after you pay off debt particularly if you close the account. While this could be due to you closing your accounts after youve paid off your debts it may also be due to getting too many hard inquiries on your account.

I am trying to qualify for a mortgage and I discovered several incorrect items on my credit report. Why are my FICO scores different than the Lenders FICO score I have been monitoring my credit report and scores with all three agencies for the past 60 days. Heres why your Credit Karma score might be higher.

You use the phrase my FICO score in your post. A drop of 15-20 points or more could be due to higher balances reported on one or more of your credit cards or it could indicate fraud or something negative impacting your credit scores adds Detweiler. Since youve noticed a steady decline over the last few months it may be the case that youve been gradually using more and more of your available credit in addition to applying for new credit accounts.

If you are frequently applying for new credit cards and loans but you do not check your credit score often you might find that your score has dropped since you last checked. That can also cause your credit score to dip temporarily. FICO Is About To Change Credit Scores.

There was 18 changes reported on my Equifax credit report for March 12th. My bank of america credit cards are much older than my citibank credit card. Your Payment Was More Than 30 Days Late.

Welcome to the forums. Credit Karma which provides free credit monitoring gives different scores than FICO. If you had an excellent credit score to begin with a collections account could easily drop it by 100 points or more.

Credit Score Drops When Nothing Changed Stay Calm. Changes in revolving credit balances can cause credit scores to fluctuate. Heres Why It Matters The firm says 40 million Americans scores will drop by more than 20 points and a similar number will rise.

One common reason is new inquiries on your report. When you pay off debt your credit score may drop for totally unrelated reasons. How to fix it -- First verify that its a legitimate debt.

Have you fully paid a mortgage car loan or personal loan. Two of those changes were balance decreases for my credit cards. Credit card balances for example.

Changes in Revolving Credit Balances. My Equifax score dropped 11 points because a remark was added to an old paid charge off account from 2014. My EQ FICO score increased 80 points and I happily called the mortgage company back.

This does not necessarily mean that youve become a credit risk - but these could be signs that credit trouble may be looming. Something else may have changed on your report but it wasnt something MyFico used to trigger an alert in the past. If not you can.

Youll get an instant boost by paying off the entire cc balance. Every time you apply for. If you keep adding more balance to your active cc FICO will drop the score.

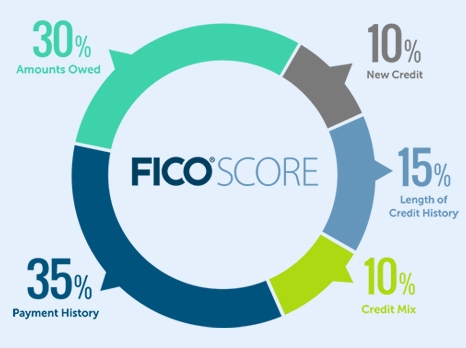

Because of this I have shared with you the reasons that my credit score was lowered 72 points according to VantageScore 30 for my Equifax dispute and I smell something fishy. If the information in your credit report changed a lower score may have resulted when your score was calculated by the credit scoring company. Payment history has the most significant impact on your credit score.

The 6 Reasons For A Credit Score Drop Mybanktracker

The 6 Reasons For A Credit Score Drop Mybanktracker

Why Did My Credit Score Drop Rapid Rescore

Why Did My Credit Score Drop Rapid Rescore

Credit Score Fluctuations Why Does My Credit Report Fluctuate

Credit Score Fluctuations Why Does My Credit Report Fluctuate

Why Did My Credit Score Drop Mintlife Blog

Why Did My Credit Score Drop Mintlife Blog

My Score Dropped 50 Points Update Myfico Forums 4838271

Why Did My Credit Score Drop Top 10 Causes

Why Did My Credit Score Drop Top 10 Causes

7 Things That Cause Fico Scores To Fluctuate

7 Things That Cause Fico Scores To Fluctuate

Why Did My Credit Score Drop Credit Karma

Why Did My Credit Score Drop Credit Karma

Why Your Credit Score Dropped 13 Common Reasons A Fico Score Declines National Credit Federation

Why Your Credit Score Dropped 13 Common Reasons A Fico Score Declines National Credit Federation

Here S What Happened To My Credit Score Once My Bankruptcy Came Off

Here S What Happened To My Credit Score Once My Bankruptcy Came Off

The Simple Chart That Can Explain Why Your Credit Score Dropped Credit Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.